Pivoting Towards Financial Independence: BRICS Proposes Shift Away from Western-Controlled Systems

An Analysis of BRICS’ Strategy to Empower African Nations and Enhance Economic Sovereignty

With increasing global financial interdependence, an intriguing development is unfolding within the BRICS economic bloc that has significant implications for African countries. Alexander Babakov, Deputy Chairman of the Russian State Duma, recently asserted that African nations will not achieve their development goals under the current global financial system, perpetuated by Western banks and funds. This assertion sheds light on the broader strategy that BRICS nations are adopting to shift away from neo-colonial financial dependencies.

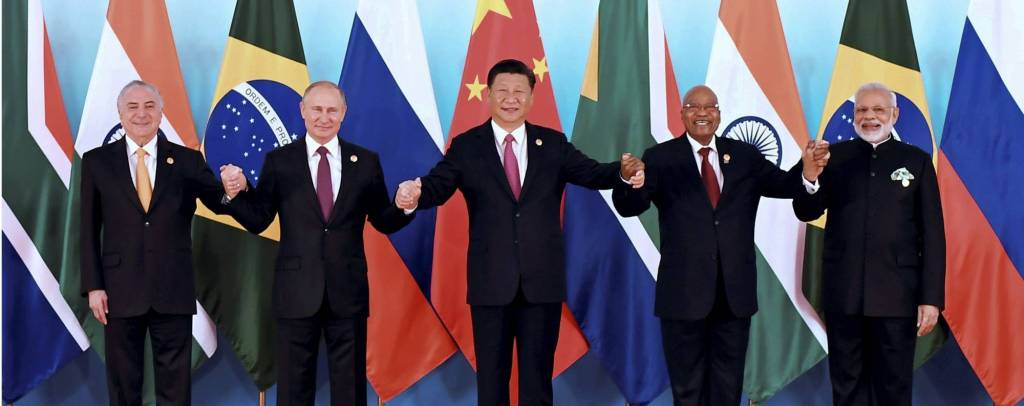

Babakov’s comments are rooted in the foundational objective of BRICS—a coalition of five major emerging national economies: Brazil, Russia, India, China, and South Africa. Formed to promote peace, security, and development in the global south, BRICS has continually aimed to establish a multipolar world order. Babakov’s remarks align with this vision, emphasizing the need for new financial infrastructures to bolster African development.

The Financial Agenda of BRICS

Babakov laid out his vision for the BRICS financial agenda, which includes a critical initiative: developing a new financial messaging system that mirrors the functionalities of SWIFT. This new system, facilitated by state-owned banks, aims to streamline transactions among BRICS countries, effectively bypassing Western financial institutions. This move is seen as pivotal in reducing dependency on Western-dominated financial systems and increasing the financial autonomy of member nations.

One notable development in this area is Egypt’s recent decision to join the BRICS Development Bank, as highlighted by BitcoinKE in a tweet. By fusing their national currencies for trade, BRICS countries, including Egypt, seek to minimize their reliance on the US dollar and other Western currencies. This move paves the way for Africa’s largest economy to participate in a more diversified financial system.

Creating New Financial Institutions

Babakov highlighted the necessity of developing new financial institutions to realize this vision. Such institutions must be compatible with existing national financial infrastructures and ensure high levels of security and data protection to thwart cyber-attacks and unauthorized access. Addressing these aspects will be crucial to the successful implementation and operation of the proposed system.

BRICS countries are already seeing significant impacts from their collective efforts. Financial reports indicate that BRICS is now the world’s largest gross domestic product (GDP) bloc, currently contributing 31.5% to the global GDP, surpassing the G7. This growing economic influence underscores the feasibility of BRICS’ financial initiatives, providing a robust foundation for the proposed changes.

The Road Ahead

Babakov argues that implementing these advanced systems will enhance economic efficiency by reducing transaction costs and speeding up capital turnover. This progress will be especially beneficial for companies involved in international trade, further driving economic growth within member nations.

The broader implications of this strategy are profound. By reducing dependency on Western-controlled financial systems, BRICS aims to empower African countries, enabling them to pursue their development goals independently and sustainably. This move could potentially reshape global financial dynamics, fostering a more equitable and multipolar economic order.

For individuals and organizations interested in these developments, it is crucial to remain informed and engaged. These financial innovations could significantly impact international trade, investment strategies, and economic policies globally.

For direct updates, you can follow us on Twitter and join our Telegram community.

For more information on BRICS and its initiatives, visit the official BRICS website.