Economic Activity in Brazil Stalls Ahead of Central Bank’s Expected Halt on Rate Cuts

Brazil’s economic momentum experienced a marked deceleration in April, according to recently released data, just days before the central bank is anticipated to pause its nearly year-long cycle of interest rate cuts. The development has cast a shadow over Latin America’s largest economy, which had shown robust performance earlier in the year bolstered by domestic demand.

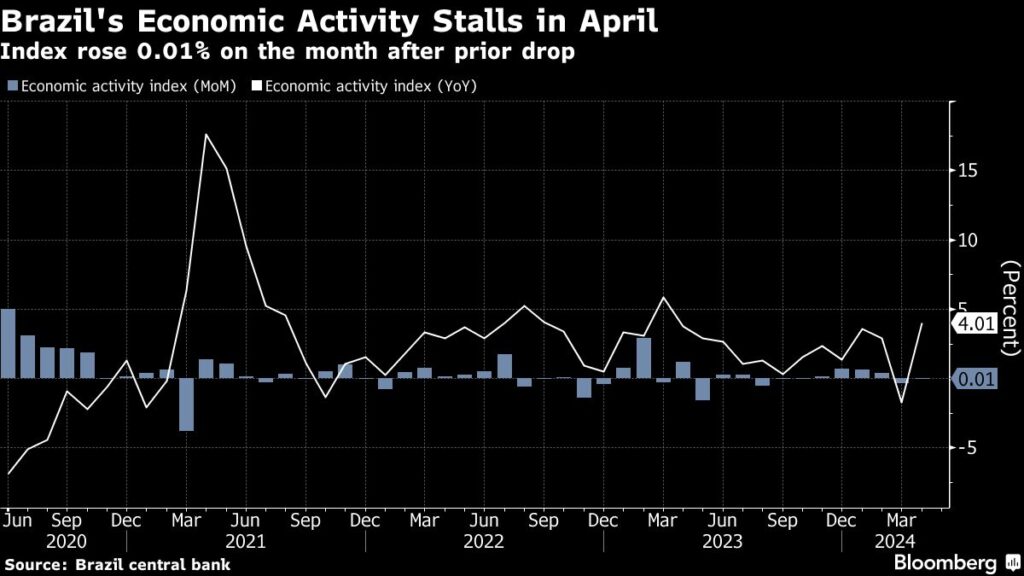

According to the central bank’s economic activity index—often regarded as a proxy for gross domestic product—the economy ticked up by a mere 0.01% from March, significantly below the median analysts’ estimate of a 0.3% increase, revealed in a Bloomberg survey. This represents the second consecutive month where the month-on-month economic performance has missed expectations. On an annual basis, however, the index recorded a 4.01% increase.

Several economic indicators point towards an impending slowdown. April witnessed a decline in industrial production and weaker-than-expected retail sales figures. Furthermore, the residual impacts of unprecedented floods in the southern regions of the country have exacerbated the situation, affecting approximately 8% of the formal job market, as detailed in a central bank study.

Adriana Dupita, an economist covering Brazil and Argentina for Bloomberg, commented, “The earlier boost to demand facilitated by court-ordered payments has waned, and tightening financial conditions are beginning to exert downward pressures on growth. Additionally, the southern floods are anticipated to impact economic activity from May onwards. The Banco Central do Brasil (BCB) had been bracing for a deceleration in growth. However, policymakers are now grappling with the realization that the economic slack is less than anticipated. We foresee the BCB maintaining the policy rate at 10.5% through the year’s end.”

Market analysts predict that policymakers, under the leadership of Roberto Campos Neto, will likely hold interest rates steady at 10.5% during their meeting on June 19. There is growing concern that the central bank may adopt a more tolerant stance on inflation as President Luiz Inacio Lula da Silva prepares to appoint a new governor and two directors later this year, in addition to having named four of the nine current board members.

In a broader economic context, President Lula reiterated his call for lower borrowing costs, underscoring their crucial role in his fiscal plans. Despite these calls, pausing rate cuts is expected to have adverse effects on household consumption and business investments—two critical drivers of this year’s economic growth.

Furthermore, Finance Minister Fernando Haddad’s attempts to stabilize public finances suffered a setback this week when Congress rejected his most recent proposal aimed at increasing revenue. In response, Haddad announced that the government will reassess its expenditure plans.

As the Brazilian economy navigates these challenging waters, the anticipation surrounding the central bank’s forthcoming decision adds another layer of complexity for investors and policymakers alike.

For a detailed analysis, visit Bloomberg News.