China’s Economic Struggle: A Deep Dive into the Current Crisis and Future Prospects

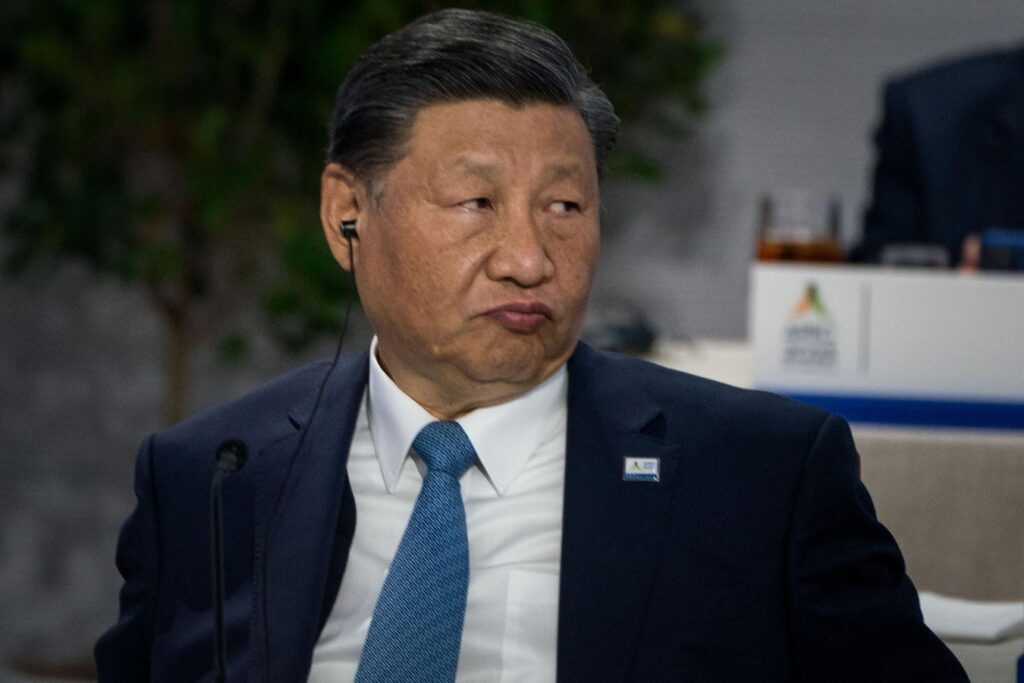

Economic turbulence continues to plague China as efforts to rejuvenate the country’s financially beleaguered property market have so far yielded disappointing results. President Xi Jinping’s recent visible frustration underscores the severity of the situation. China’s extensive stimulus measures, primarily focused on the real estate sector, have yet to catalyze a much-needed economic turnaround.

The Root of the Crisis: The Property Sector

China’s economic woes trace back to 2021, with the real estate sector at the epicenter. Despite years of neglect, the Chinese authorities began recognizing the gravity of the problem towards the end of last year. The stimulus plan they rolled out aimed to mitigate the burden of excess housing supply on property values and to stimulate household buying interest.

One of the primary strategies has been the reduction of interest rates by the People’s Bank of China (PBOC). However, the PBOC’s response has been underwhelming. In a more drastic move, Beijing removed the long-standing minimum interest rates on mortgages and introduced special provisions for Chinese banks to increase lending to homebuyers. Most notably, the government utilized central government credit to accumulate approximately 1 trillion yuan (about $140 billion) to purchase vacant properties.

Disheartening Results

Despite these interventions, signs of improvement remain elusive. Home sales have nosedived, with figures for the first five months of the year showing a drop of 30.5% compared to the same period last year. Furthermore, new home prices continue to fall; in May, residential real estate prices in major Chinese cities were 4.3% lower than in May 2022, an accelerated decline from April’s 3.5% drop.

With a significant portion of Chinese wealth invested in property, this decline has dampened consumer spending. Although retail sales in May showed a 3.7% increase from the previous year—better than April’s 2.3% rise—it still falls short of Beijing’s 5% real growth target.

Private Sector Reluctance

The pervasive uncertainty in the real estate market has also impacted private business sentiments, with companies hesitant to invest in expansion, modernization, or hiring. This reluctance has added to the economic inertia.

Manufacturing: A Glimmer of Hope?

Amidst the gloom, the manufacturing sector has shown some resilience. Industrial production increased by 5.6% in May compared to a year ago. This figure, though promising, is tempered by the reality of existing production exceeding domestic demand, raising concerns about the future market for these goods. The situation is further complicated by tariffs imposed by both the United States and the European Union on Chinese products, including electric vehicles (EVs).

Decline in Foreign Investment

Another concerning aspect of China’s current economic situation is the continued decline in foreign investment. This decline is troubling for a country that has historically depended on foreign capital to bolster its technological advancements and economic vitality. Beijing’s National Bureau of Statistics reported that foreign direct investment (FDI) for the first five months of this year amounted to 412.5 billion yuan (about $568 million), a sharp 30% decrease from last year. This marks the 12th consecutive month of declining FDI, further exacerbating the economic strain.

The Road Ahead

While officials in Beijing may argue that the newly implemented policies need time to manifest their benefits, the immediate figures paint a challenging picture. President Xi Jinping and other leaders may remain hopeful, but the statistics suggest that economic relief is still distant. As the authorities continue to grapple with these economic challenges, they must also contend with a disheartened public and a wary business community.

For more context and updates on China’s economic policies, visit China’s Official Government Website.