Unearthing Value in General Electric: An Analysis of GE Aerospace’s Market Dominance and Growth Potential

General Electric, commonly known as GE, has long been entangled in a narrative of dramatic rise and fall. However, recent shifts have positioned the company, particularly its aerospace division, as a potential goldmine for investors. A deeper examination reveals that GE Aerospace not only holds significant market power but also offers considerable opportunities for reinvestment and growth.

Historical Context: The Rollercoaster of GE

Founded in 1892, GE rose under the legendary leadership of Jack Welch from a $14 billion industrial company in 1981 to a $600 billion conglomerate by his retirement in 2001. However, the era following Welch saw GE’s decline under Jeff Immelt, culminating in a desperate restructuring phase under subsequent leadership till 2018. The decline of GE was so profound that it inspired the book Lights Out: Pride, Delusion, and the Fall of General Electric, offering a detailed account of the conglomerate’s setbacks.

Larry Culp’s Turnaround Strategy

In October 2018, Larry Culp, former CEO of Danaher, stepped in with a robust strategy focused on debt reduction and strategic asset sales. His tenure began with significant divestitures: the sale of GE’s biopharma assets to Danaher for approximately $20 billion in 2020, and the sale of leasing assets to AerCap for $30 billion in 2021. This aggressive debt reduction amounted to nearly $100 billion, setting the stage for GE’s operational restructuring.

By January 2023, GE had spun off GE Healthcare, which now boasts a market capitalization of around $35 billion. Later in the year, GE Vernova emerged after GE divested 100% of its energy business, now valued at approximately $50 billion.

Focusing on GE Aerospace

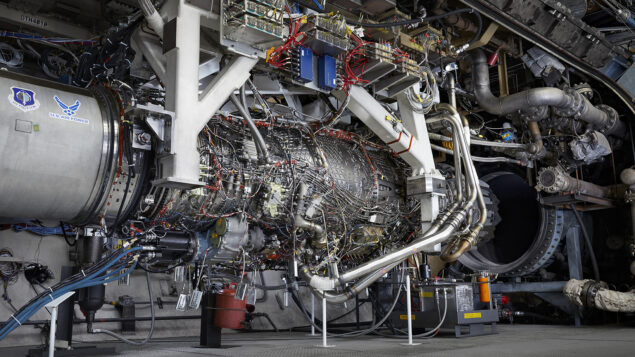

Today, GE Aerospace stands as a leader in the global jet engine market under Larry Culp’s leadership. Approximately 75% of its revenue stems from its Commercial Engines and Services (CES) division, commanding a market share of around 70%. The remaining 25% comes from Defense and Propulsion Technologies (D&PT), where GE holds a 40% market share.

The jet engine business model is intricately structured around high-margin aftermarket services, which generate more than 3.5 times the revenue of initial engine sales. Airlines, leasing companies, and stringent FAA regulations ensure that customers predominantly purchase original equipment manufacturer (OEM) parts, establishing a durable "lock-in" effect that safeguards GE’s market pricing power.

Market Dynamics and Future Growth

The aerospace industry dynamics favor GE Aerospace. Despite facing competition, GE has continued to grow its market share and enhance its customer trust through sustained investments in innovation. The need for airlines to upgrade fleets for better fuel efficiency amid tightening ESG requirements further supports the case for reinvestment in new GE engines, which are about 15% more efficient than their predecessors.

Operational Excellence and Leadership

Larry Culp’s commitment to lean manufacturing principles and strategic capital allocation has been pivotal. His history at Danaher, where he achieved significant shareholder returns, underscores his capability to drive similar success at GE. The structuring of Culp’s compensation aligns his personal interests with long-term organizational success, fortifying investor confidence.

Financial Projections

Looking ahead, GE Aerospace is poised to benefit from steady growth in air travel and its dominant market position. The expected compounded annual growth rate (CAGR) of 4-6% for engine volumes, combined with pricing power, projects a revenue CAGR of around 9%. Additionally, operational efficiencies from lean methodologies are anticipated to drive free cash flow growth in the low double digits over the next decade.

Despite trading at a premium valuation of 30 times the estimated 2025 earnings, compared to the Aerospace and Defense sector’s 22 times, GE’s defensible business model, high incremental returns on capital, and substantial shareholder distributions make it an attractive investment.

Conclusion

GE’s historical legacy, combined with its transformative recent trajectory under Larry Culp’s leadership, has unveiled a rejuvenated aerospace division with robust market power and growth potential. Investors can take confidence in GE Aerospace’s sustainable competitive advantages and strategic vision, setting the stage for long-term value creation.

For more information on General Electric, visit GE’s official website.