Brazil’s Economic Stagnation Complicates Central Bank’s Rate Decisions

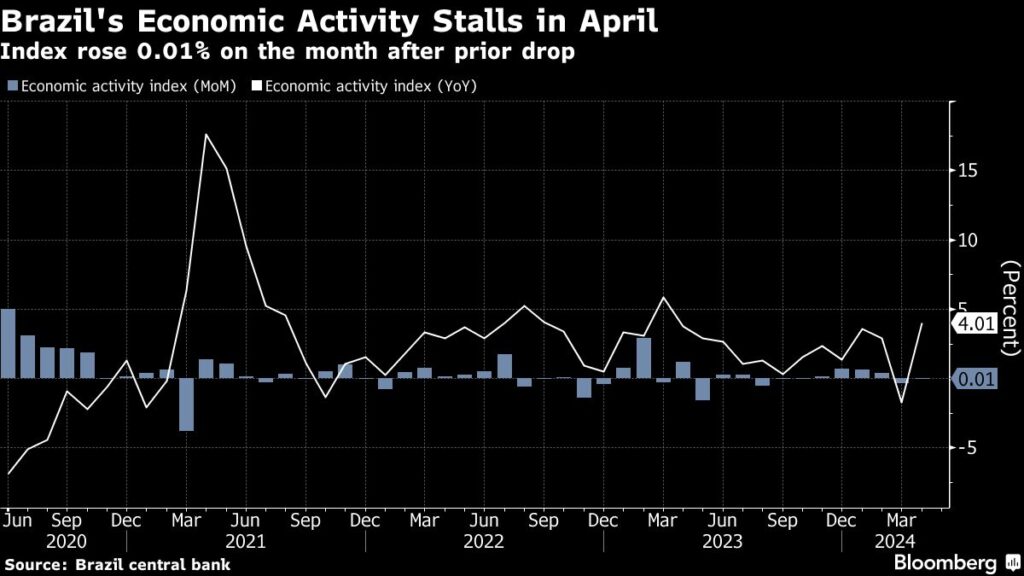

Bloomberg – Economic activity in Brazil ground to a halt in April, according to a recent report that precedes an anticipated pause in the central bank’s nearly year-long cycle of interest rate cuts.

The central bank’s economic activity index, a surrogate for gross domestic product (GDP), edged up a mere 0.01% from March, falling short of the 0.3% median forecast from analysts surveyed by Bloomberg. This marks the second consecutive month where figures were below expectations. However, the index recorded a 4.01% increase compared to the same period last year, as revealed in data published on Friday.

Market Expectations and Economic Indicators

Latin America’s largest economy, Brazil, is expected by investors to experience a slowdown following a robust start to the year propelled by strong domestic demand. April saw a decline in industrial production and weaker-than-anticipated monthly retail sales. Additionally, the aftereffects of unprecedented floods in the southern regions continue to plague the economy, impacting 8% of the country’s formal job workers, according to a central bank study.

Economic Outlook

Adriana Dupita, an economist specializing in Brazil and Argentina at Bloomberg Economics, observed, “The boost to demand from court-ordered payments earlier this year has dissipated, and tighter financial conditions are likely to drag on growth. The floods in Southern Brazil may also weigh on activity beginning in May. The BCB [Banco Central do Brasil] had anticipated growth to decelerate. Policymakers are increasingly concerned about the possibility of less economic slack than initially thought. We project that the BCB will maintain the policy rate at 10.5% through the end of the year.”

Policy Predictions Amid Political Pressures

Policymakers led by Central Bank President Roberto Campos Neto are expected to keep rates steady at 10.5% on June 19. Nonetheless, there is apprehension that the institution may adopt a more lenient stance on inflation once President Luiz Inácio Lula da Silva appoints a new governor and two directors later this year, having already appointed four out of nine board members.

President Lula recently reiterated his calls for lower borrowing costs, positing them as central to his strategy to stabilize public finances. However, a hiatus in rate cuts is poised to dampen both household consumption and business investment—two critical pillars of economic growth observed so far this year.

Financial Measures and Legislative Hurdles

Finance Minister Fernando Haddad’s efforts to bolster public finances faced a significant setback this week after Congress rejected his latest revenue-raising proposal. In response, Haddad announced that the government will reassess its expenditures.

This article draws on data and commentary from Bloomberg ©2024 Bloomberg L.P.