IMF Slashes Saudi Arabia’s Growth Forecast Amid Oil Production Cuts

Riyadh (Bloomberg) — The International Monetary Fund (IMF) has revised its growth projections for Saudi Arabia, reducing them more significantly than for any other major economy it monitors, a move reflecting the kingdom’s decision to cut oil supplies.

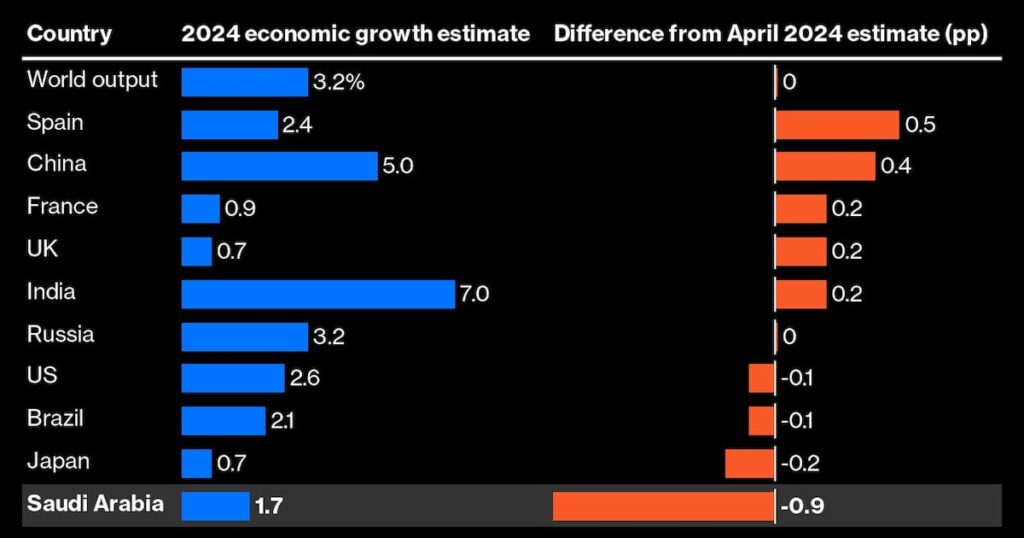

According to the IMF’s latest World Economic Outlook, Saudi Arabia’s gross domestic product (GDP) is expected to grow by just 1.7% in 2024, down from the 2.6% forecast made in April. The outlook for 2025 has been adjusted downward to 4.7% from 6%.

For comparison, the IMF estimates that global GDP will increase by 3.2% this year, while the United States is projected to grow by 2.6%.

These reductions in growth projections could impact Saudi Arabia’s government revenues, particularly at a time when the kingdom is amassing billions in debt to finance Crown Prince Mohammed bin Salman’s ambitious economic transformation plans.

“The downward revision is entirely due to the impact of the production cuts,” stated Petya Koeva Brooks, Deputy Director at the IMF, during a press briefing on Tuesday.

In 2023, Saudi Arabia, along with other OPEC+ members, trimmed crude output to bolster oil prices, and these production curbs are set to extend well into 2024.

Although Brent crude prices have risen approximately 9% this year to just under $84 a barrel, this figure remains below the level Riyadh requires to balance its budget. The IMF estimates that Saudi Arabia needs oil prices to be around $96 per barrel for budget equilibrium. Bloomberg Economics suggests the break-even price is even higher, at $109 per barrel, when considering the sovereign wealth fund’s domestic investments.

As the world’s largest crude exporter, Saudi Arabia reduced output to 9 million barrels per day last year, approximately 1 million barrels below its average over the past decade, causing a contraction in what was the fastest-growing economy within the Group of 20 in 2022.

The Saudi government has long been emphasizing the growth of its non-oil economy, which employs the majority of the Saudi population and is central to Crown Prince Mohammed bin Salman’s Vision 2030 initiative. However, this sector has also shown signs of slowing, recording its slowest growth since the COVID-19 pandemic in the first quarter of 2024.

The IMF’s revision of Saudi Arabia’s growth has also influenced the growth projections for the wider region. The fund has lowered its estimates for the Middle East and Central Asia from 2.8% to 2.4% for this year.

source: Bloomberg