Debate Over Excluding Food Prices from India’s Inflation Targeting Framework Intensifies

India’s financial policy landscape is buzzing with discussion following a top government adviser’s suggestion to exclude volatile food prices from the nation’s inflation targeting framework. The proposal, featured in the government’s pre-budget Economic Survey, has elicited mixed reactions from economists and policymakers.

India’s Chief Economic Adviser, V. Anantha Nageswaran, put forth the idea that monetary policy tools are ineffective against food price inflation, often driven by supply constraints. He argued that short-term monetary strategies could be counterproductive when dealing with food prices, which are largely influenced by factors beyond the central bank’s control, such as weather conditions and supply chain disruptions.

The Controversial Proposal

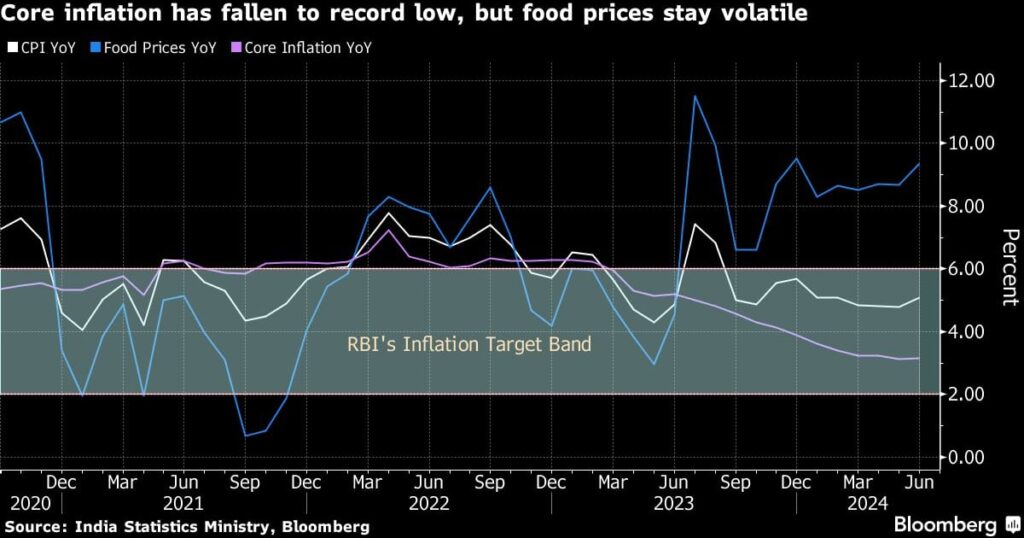

The proposal has been met with skepticism, especially in a country where food constitutes nearly half of the Consumer Price Index (CPI) basket. Economists like Sonal Varma from Nomura Holdings Inc. argue that ignoring food prices is impractical, given their significant impact on everyday expenses for consumers. The Reserve Bank of India (RBI) aims to maintain headline inflation within a 2%-6% range and adjusts its monetary policies accordingly. Altering the framework to exclude food prices could deviate from this mandate, which is reviewed every five years with the next revision slated for March 2026.

Expert Opinions

Alexandra Hermann, an economist with Oxford Economics, also voiced her concerns, stating that excluding food prices from the inflation targeting framework is unsuitable. She suggested a more nuanced approach—revaluating the weights in the CPI basket, improving food storage, processing, and transportation, and enhancing irrigation systems to reduce farmers’ dependency on favorable weather.

Kunal Kundu, India economist for Societe Generale SA, however, believes there is merit in Nageswaran’s argument. "Food inflation is not a monetary phenomenon," Kundu said. He emphasized that monetary policy has limited influence over food prices, suggesting fiscal interventions as a more effective approach. Furthermore, Kundu highlighted that core inflation, which excludes the volatile food and fuel costs, remains subdued, pointing to weak domestic demand.

Policy Implications

One of the critical issues is that food prices are a crucial input in many products. Any increase in food prices can cascade through the economy, raising the costs of numerous goods and services. This observation has kept the RBI vigilant, maintaining its current monetary stance for over a year to mitigate the potential ripple effects of food price spikes on the broader economy.

The recent consumption expenditure survey from February reveals that food remains a primary expense for both rural and urban households, albeit with a decreasing share compared to a decade ago. This highlights the enduring importance of food prices in assessing the overall inflation and economic health of the nation.

Long-Term Considerations

While the suggestion to exclude food prices from the CPI basket has its proponents, any changes to the inflation targeting framework would require thorough analysis to ensure its resilience against future economic shocks. The credibility of India’s flexible inflation targeting regime could be at stake, necessitating a robust and comprehensive evaluation.

As discussions continue, the immediate focus remains on maintaining a balanced approach that considers the multifaceted nature of inflation, especially in a diverse and populous country like India. The debate underscores the complexities policymakers face in designing effective monetary policies that address both short-term challenges and long-term economic stability.

For more information, visit Reserve Bank of India.

©2024 Bloomberg L.P.