China Set to Maintain Benchmark Lending Rates Amid Economic Headwinds

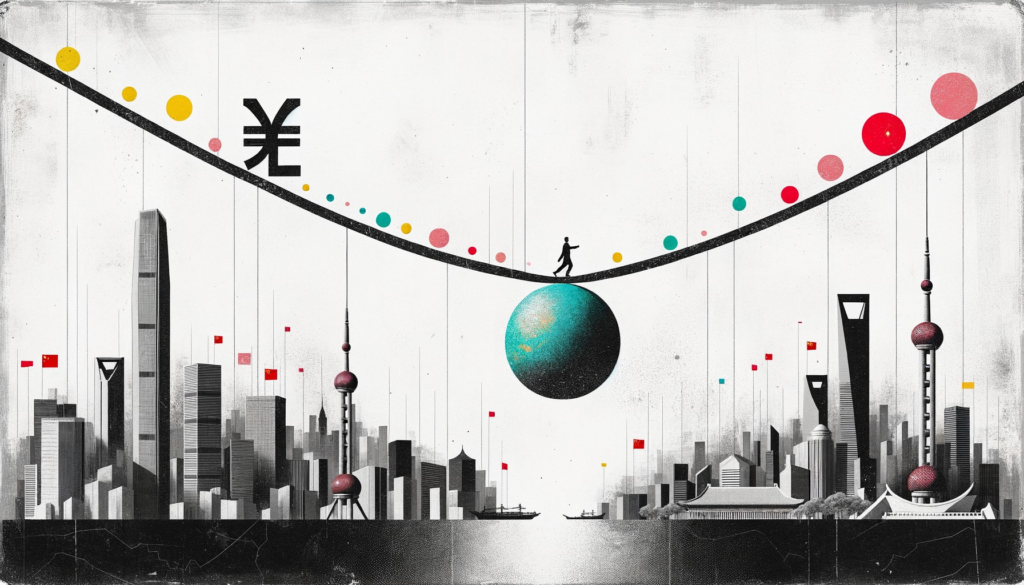

BEIJING— In a move anticipated by market analysts, China is expected to hold its benchmark lending rates steady this Thursday, despite a slew of economic indicators that have persistently fallen short of expectations. This forecast, derived from a recent Reuters survey, underscores the tightrope that Chinese policymakers are walking as they navigate a complex economic landscape.

Economic Balancing Act

The Loan Prime Rate (LPR), which serves as a pivotal interest rate for banks’ most creditworthy clients, is established monthly after20 commercial banks submit their respective rates to the People’s Bank of China (PBOC). This intricate process, which reflects the nuances of China’s vast financial system, has garnered heightened scrutiny this week. The majority of economists predict that both the one-year and five-year LPRs will remain unchanged. However, a vocal minority is advocating for minor reductions.

Adding to the credibility of these projections, the central bank recently maintained the one-year medium-term lending facility (MLF) rate at its current level. This move signals the PBOC’s intent to keep rates steady, despite internal and external pressures. Notably, the valuation of China’s yuan continues to be a focal point of concern, weighed down by a pronounced yield differential with developed countries, most notably the United States. This is exacerbated by domestic constraints such as the net interest margins of lenders.

While theoretically, there is room to adjust rates downward, the PBOC has displayed a cautious stance, prioritizing currency stability in the face of a tentative economic recovery and persistent difficulties in the property market.

Market Implications

China’s potential decision to maintain lending rates underscores a delicate balance between spurring economic growth and ensuring currency stability. This posture is poised to influence market conditions significantly—a fact not lost on global investors. Given the disparities in global yield and ongoing domestic economic challenges, investors must closely monitor policy impacts on sectors like real estate and banking, both of which are already showing signs of strain.

Broader Economic Impact

The ramifications of China’s economic strategy extend beyond its borders, with significant consequences for global markets. The precipitous decline in new home prices—the most rapid in nearly a decade—alongside lower-than-forecast new bank lending, point to the urgent need for potential policy support measures. These could be unveiled around or following the July Politburo meeting. The international community, particularly those with vested interests in trade and investment with China, awaits these developments with bated breath, as they could be critical to stabilizing and energizing the world’s second-largest economy.

For more in-depth coverage, visit Reuters.